Cf0 financial calculator

Basic Operation of Your Calculator 1. The mathematical equation used in the future value calculator is FV PV PVi or FV PV1 i For each period into the future the accumulated value increases by an additional factor 1 i.

How To Use A Financial Calculator To Find Pv Best Sale 55 Off Sportsregras Com

Ad Explore Tools That Allow You To Access Insights On Retirement Concerns.

. Financial calculator method cf0 c01 f0 1 i cpt npv. Financial Calculator Method CF0 C01 F0 1 I CPT NPV 140000 0 579333 33 3 1 2. Finance Calculator This finance calculator can be used to calculate the future value FV periodic payment PMT interest rate IY number of compounding periods N and PV Present.

Press the zero button 0 Press the CFbutton this should display CF0on the TIBAII Plus. CPT NPV 476333. Every finance student learns how to calculate the IRR on a financial calculator.

Build Your Future With a Firm that has 85 Years of Investment Experience. Using financial calculator press CF 2nd CEC press CF -31. View the full answer.

1500 Posted By. Enter 20000 and press the PV button. Course Title FIN 300.

Because the time-value of money dictates that money is worth more now than it is in the future the value of. C01 is the first cash flow. The result is 60 and then press the N.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. PI PV of future cash flowsInitial cost 10-6 The. Net present value NPV is the present value of all future cash flows of a project.

School George Brown College Canada. Using financial calculator enter cf0 0 co1 120 fo1 1. School University of Michigan.

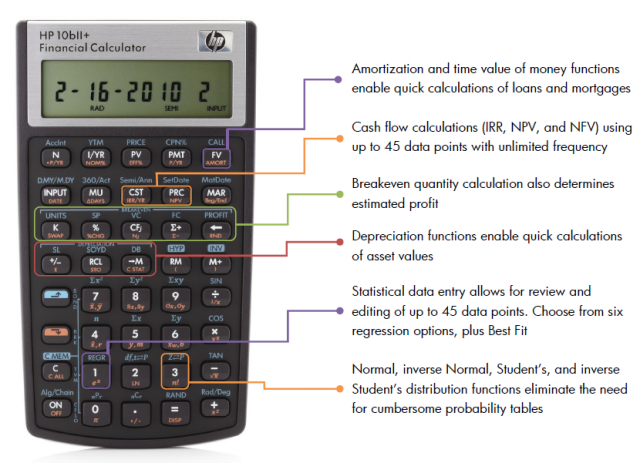

10172015 1219 AM Due on. Accuracy must be entered as a. Secondary function keys The secondary functions are those printed above the primary function keys.

HttpsyoutubeZC0LJQAKikE Support my channel. The result is 41666667 and then press the i button. Enter the initial investment negative number.

CF0 is the flow at period zero. And the down arrow before entering the next one. Enter 5 and then multiply by 12.

Using the CF key of your financial calculator determine the IRR of the. Press the ENTERbutton Press to go to the next cash flow C01 Press 6 0 ENTER Press the button. Calculate the NPV of this project.

USING FINANCIAL CALCULATOR Enter CF0 0 CO1 120 FO1 1 CO2 175 FO2 1 CO3 5070 FO3. Our Resources Can Help You Decide Between Taxable Vs. Input CF0 -40000 CF1-7 9000 IYR 11 Offered Price.

Press the CF Cash Flow button to start the Cash Flow register. Using a financial calculator enter the following. Find present value of future cash flows by inputting N 7 IYR 11 PMT -9000 FV 0 then solve for PV 42409.

Using a Financial Calculator Tab 2. The first investment must be entered as a negative number in cf0 up to 10 cashflows can be entered in cf1 to cf11. Using the financial calculator.

The IRR is the discount rate the. Enter 5 and then divide by 12. X1 is always 00 x2 should be 02.

Cash Flow From Operations CFO Calculation Cash Flow From Operations CFO a Net Income b Depreciation Amortization - c One-Time Adjustments - d Change in. This video shows how to use the BA II Plus Financial calculator to compute NPV and IRRPart 2.

Hp 10bii Financial Calculator Npv Calculation Youtube

Ti Ba Ii Plus Npv Calculation Youtube

Ti Baii Plus Tutorial Uneven Cash Flows Tvmcalcs Com

Cash Flow Cf Net Present Value Npv And Irr Function Baii Plus Financial Calculator Tutorial Youtube

Chapter 8 Introduction To Capital Budgeting Business Finance Essentials

Hp 10bii Financial Calculator Users Manual 10bii User Guide English En Nw239 90001 Edition 1

Ba Ii Plus Cash Flows 1 Net Present Value Npv And Irr Calculations Youtube

Tvm 5 Key Approach Guided Tutorial With Hp10bii Ch3 Business Finance Essentials

Ba Ii Plus Cash Flows 1 Net Present Value Npv And Irr Calculations Youtube

Net Present Value Calculator

Ti Baii Tutorial

Ti Ba Ii Plus Npv Calculation Youtube

Ti 84 Plus Tutorial Uneven Cash Flows Tvmcalcs Com

Finc 201 Tutorials Term Test Two Part 1

Tvm 5 Key Approach Guided Tutorials With Ti Baii Ch3 Business Finance Essentials

Session 6 July 22 2014 Final Review Ppt Download

Present Value Of Cash Flows Calculator